403b 2024 Contribution Limit Chart By Year. The limit on annual additions (the combination of all employer contributions and employee elective salary deferrals to all 403 (b) accounts). It’s a good idea to know those limits and plan your 401 (k) contribution strategy accordingly.

The 2024 retirement plan contribution limits. 403(b) contribution limits in 2023 and 2024.

401K 2024 Contribution Limit Chart.

The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year was $6,500 or $7,500 if you were age 50 or older.

It’s A Good Idea To Know Those Limits And Plan Your 401 (K) Contribution Strategy Accordingly.

For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2024.

For 2024, The Limit On Annual Additions Has Increased From $66,000 To $69,000.

Images References :

Source: editheqcharmain.pages.dev

Source: editheqcharmain.pages.dev

Max 403b Contribution 2024 Jeanne Maudie, For distributions made after december 31, 2023, an. Contribution limits for 403(b)s and other retirement plans can change from year to year and are adjusted for inflation.

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, The annual 403 (b) contribution limit for 2024 has changed from 2023. The 401 (k) contribution limit for 2024.

Source: www.canbyfinancial.com

Source: www.canbyfinancial.com

2024 retirement plan contribution limits, The 401 (k) contribution limit for 2024. In 2024, employees can contribute up to $23,000 per year to their 403(b) plan, up from $22,500 in 2023.

Source: karlabbeatriz.pages.dev

Source: karlabbeatriz.pages.dev

Irs Limits On 401k Contributions 2024 Meg Margeaux, Updated on may 23, 2022. If you are age 50 or older in.

Source: patriziawbekki.pages.dev

Source: patriziawbekki.pages.dev

Coverdell Ira Contribution Limits 2024 Inge Regine, If you are under age 50, the annual contribution limit is $23,000. This rises to $23,000 in 2024.

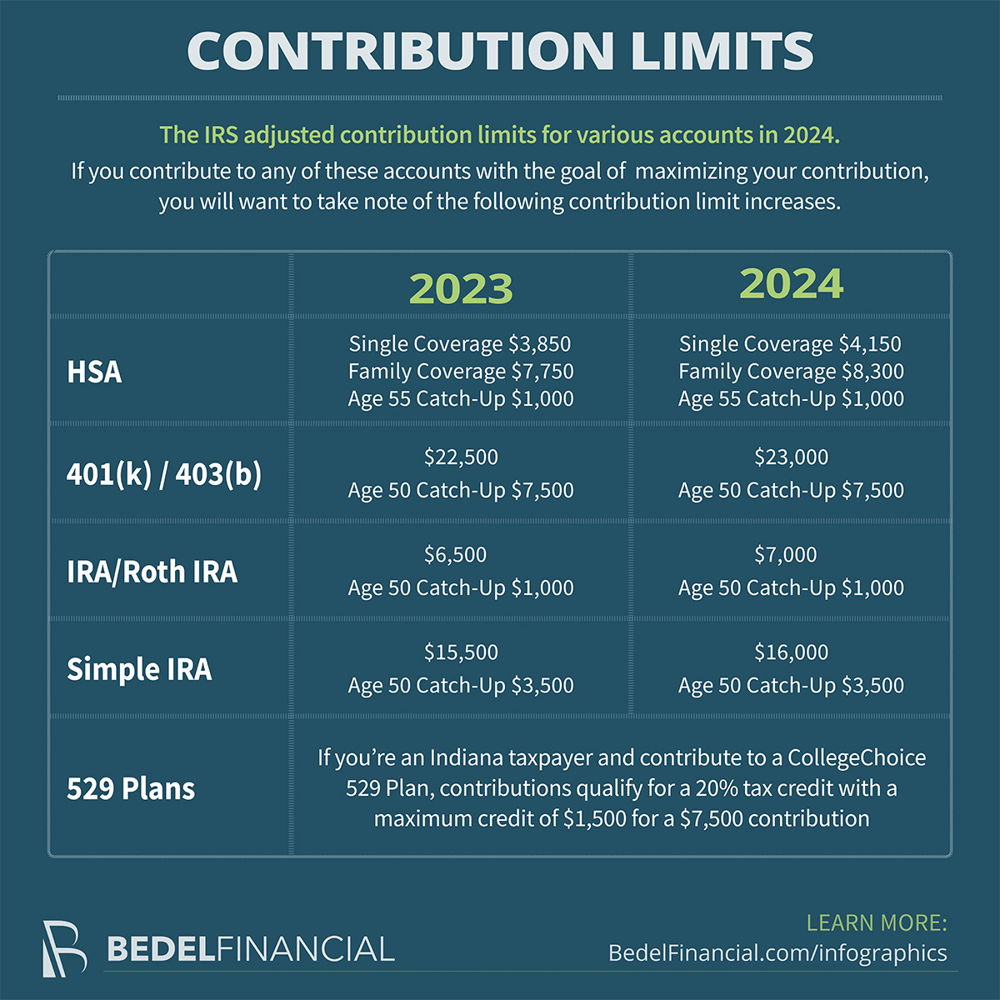

Source: www.bedelfinancial.com

Source: www.bedelfinancial.com

2024 Contribution Limits, If you're 50 or older, you can contribute an. Annual 401k contribution 2024 gnni harmony, entering 2024, the contribution limits for 401 (k), 403 (b), 457 plans, and the federal government's thrift savings plan will be set at.

Source: zaharawgiulia.pages.dev

Source: zaharawgiulia.pages.dev

Social Security Tax Contribution Limit 2024 Nola Natalee, This rises to $23,000 in 2024. For 2023, employees could contribute up to $22,500 to a 403 (b) plan.

Source: marcillewgayel.pages.dev

Source: marcillewgayel.pages.dev

Irs Hsa 2024 Contribution Limits Avis Kameko, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year was $6,500 or $7,500 if you were age 50 or older. The limit on annual additions (the combination of all employer contributions and employee elective salary deferrals to all 403 (b) accounts).

Source: vittoriawdodie.pages.dev

Source: vittoriawdodie.pages.dev

2024 Hsa Contribution Limits Irs Cybil Dorelia, 403 (b) max contribution for 2024. Ira 2024 contribution limit chart by year.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, If you're over 50, you. You can tuck quite a bit away into your 403 (b) plan, but the irs does set limits to how.

If You Are Under Age 50, The Annual Contribution Limit Is $23,000.

In 2024, employees can contribute up to $23,000 per year to their 403(b) plan, up from $22,500 in 2023.

The Total Employee Contribution Limit To All 401 (K) And 403 (B) Plans For Those Under 50 Will Be Going Up From $22,500 In 2023 To $23,000 In 2024 (Compare That To The.

The basic employee contribution limit for 2024 is $23,000 ($22,500.